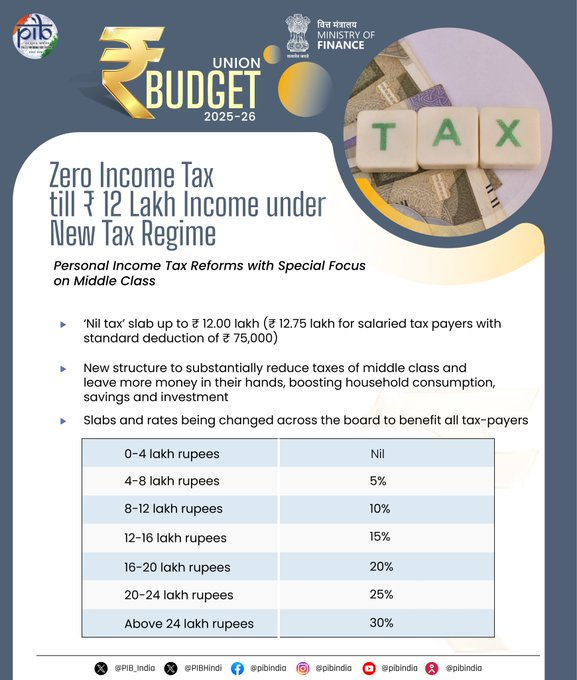

Finance Minister Nirmala Sitharaman announces no income tax up to ₹12 lakh under the new regime in Union Budget 2025, providing major relief for the middle class.

Union Budget 2025: Big Tax Relief for the Middle Class

In a much-anticipated move, Union Finance Minister Nirmala Sitharaman unveiled the Union Budget 2025, announcing significant income tax relief for the middle class. One of the key highlights of the budget was the introduction of a tax-free income threshold up to ₹12 lakh, making the new tax regime more favorable for a large segment of taxpayers.

This tax relief, which extends to ₹12.75 lakh including standard deductions, has sparked applause and celebration from the ruling BJP party, including Prime Minister Narendra Modi. The announcement is expected to substantially ease the financial burden on middle-income earners, boosting their disposable income.

Key Changes in Income Tax Slabs for Budget 2025

Revised Tax Slabs Under the New Regime

In her speech, Sitharaman detailed the revised income tax slabs under the new tax regime, which promises lower tax rates and increased exemptions for the middle class. The new tax structure is designed to reduce the overall tax burden for individuals and encourage more consumption and savings, which can further stimulate economic growth. Here are the key changes in the income tax slabs:

- Income up to ₹4 lakh: No tax

- Income between ₹4 lakh and ₹8 lakh: 5% tax

- Income between ₹8 lakh and ₹12 lakh: 10% tax

- Income between ₹12 lakh and ₹16 lakh: 15% tax

- Income between ₹16 lakh and ₹20 lakh: 20% tax

- Income between ₹20 lakh and ₹24 lakh: 25% tax

- Income above ₹24 lakh: 30% tax

This new tax structure is intended to leave more money in the hands of taxpayers, which can help stimulate household consumption, savings, and investment in the economy.

Benefits of the New Tax Regime

1. Greater Relief for the Middle Class

By removing income tax obligations up to ₹12 lakh, the new regime offers immediate and tangible financial relief to millions of middle-class families across India. This move is particularly beneficial for salaried employees, small business owners, and self-employed professionals, who will see significant reductions in their tax liabilities.

2. Boost to Economic Growth

With lower taxes, the middle class will have more disposable income, which is likely to increase household spending. This can create a positive ripple effect throughout the economy, encouraging demand for goods and services. In turn, this can help businesses grow, create jobs, and drive overall economic growth.

3. Simplification of the Tax System

Along with the revised tax slabs, Sitharaman also emphasized the importance of making the tax system simpler and easier to understand. This is part of the government’s ongoing effort to ensure that taxpayers can comply with tax laws without confusion or unnecessary complications.

Upcoming Changes: New Direct Tax Code

In addition to the tax slab revisions, Finance Minister Nirmala Sitharaman also announced plans to introduce a new direct tax code next week. The goal of this new code is to simplify the tax compliance process and make the Income Tax Act more accessible and understandable to taxpayers.

Key Features of the New Tax Code:

- Reduction of Complexity: The new code is expected to reduce the length of the Income Tax Act by 60%, cutting down on unnecessary complexity.

- Scrapping of the Financial Year and Assessment Year: One of the most anticipated changes is the removal of the confusing distinction between the financial year (FY) and assessment year (AY). This change is likely to simplify the way taxpayers track and report their income.

- Tax on Insurance Income: The new tax code may introduce a 5% tax on income derived from life insurance policies, which were previously exempt.

- Standardization of Dividend Tax: The code could standardize the tax rate on dividend income, currently taxed at slab rates, to a fixed rate of 15%.

The new code aims to create a more transparent, user-friendly tax system and reduce litigation by simplifying tax laws. Notably, the new code will eliminate the option for taxpayers to choose between the old and new tax regimes, which had previously caused some confusion.

Impact of Budget 2025 on the Indian Economy

Fiscal Deficit and Economic Outlook

Union Finance Minister Nirmala Sitharaman has projected the fiscal deficit for FY 2025-26 to be 4.4% of GDP. This aligns with the government’s focus on managing public finances while implementing measures to stimulate growth. The tax relief measures in the budget are expected to provide immediate relief to taxpayers, and the long-term focus on infrastructure, innovation, and regional connectivity will likely support economic growth in the coming years.

Focus on Infrastructure and Regional Development

Sitharaman also emphasized investments in infrastructure, with a special focus on regional connectivity. The government has committed to building greenfield airports in Bihar, improving transport connectivity, and promoting tourism in underserved regions. The modified ‘Udaan’ scheme, which aims to improve air connectivity, is also set to enhance travel options for the middle class, especially in rural and remote areas.

Conclusion: A Budget for the Middle Class and Beyond

Union Budget 2025 brings significant tax relief for India’s middle class, with the introduction of no income tax up to ₹12 lakh under the new regime. These changes, coupled with the new direct tax code set to be introduced next week, reflect the government’s commitment to simplifying the tax system and reducing the financial burden on taxpayers.

The revised tax slabs and other measures aimed at boosting household savings, consumption, and investment are expected to have a positive impact on the economy. The government’s continued focus on infrastructure, innovation, and regional development will also contribute to long-term economic growth, creating a more robust and resilient economy for the future.