Finance Minister Nirmala Sitharaman unveils Union Budget 2025, offering significant tax relief, including ₹12 lakh income tax exemption under the new tax regime.

Union Budget 2025: Key Highlights and Income Tax Relief for the Middle Class

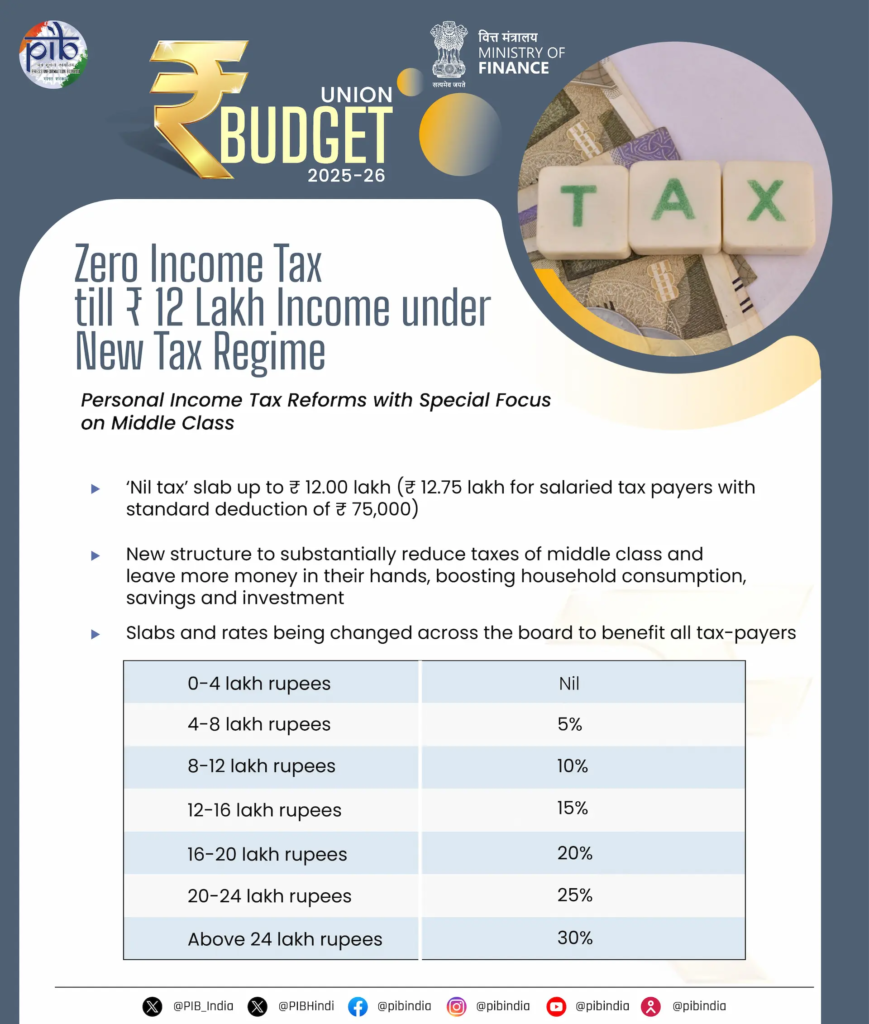

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman in Parliament, brought much-needed relief to the middle class, with a historic income tax exemption up to ₹12 lakh under the new tax regime. This budget marks Sitharaman’s eighth consecutive presentation, a unique record in India’s political history. With the country eagerly awaiting measures that would reduce financial strain, the Finance Minister laid out a series of tax reforms, economic initiatives, and strategic investments aimed at boosting the economy.

Key Highlights of Union Budget 2025

1. Major Income Tax Relief for the Middle Class

A significant announcement in the Union Budget 2025 was the proposal for income tax exemption up to ₹12 lakh. In a move aimed at benefiting the middle class, Finance Minister Nirmala Sitharaman confirmed that taxpayers earning up to ₹12 lakh would not have to pay any income tax under the new tax regime. This initiative is set to simplify tax obligations and ease the financial burden for a large section of India’s working population.

Additionally, the Finance Minister revealed that a new and simplified income tax bill will be introduced next week. The new bill promises to streamline the tax process, reduce litigation, and make tax filing easier for all taxpayers.

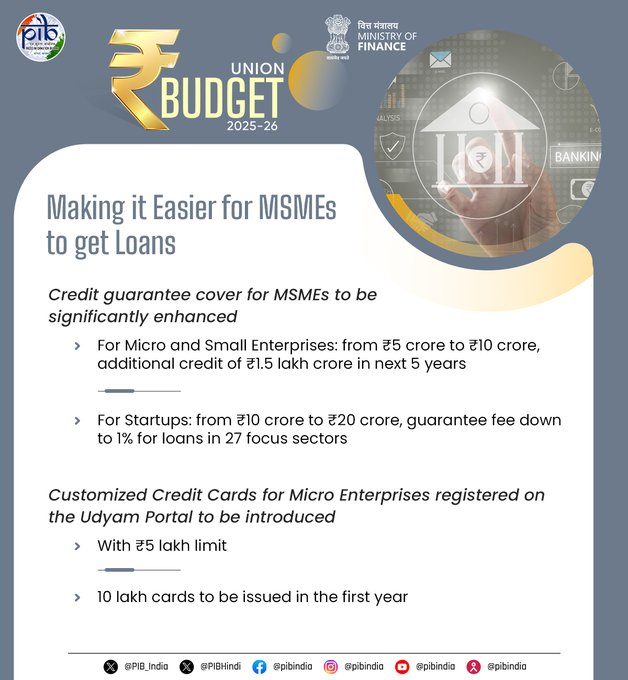

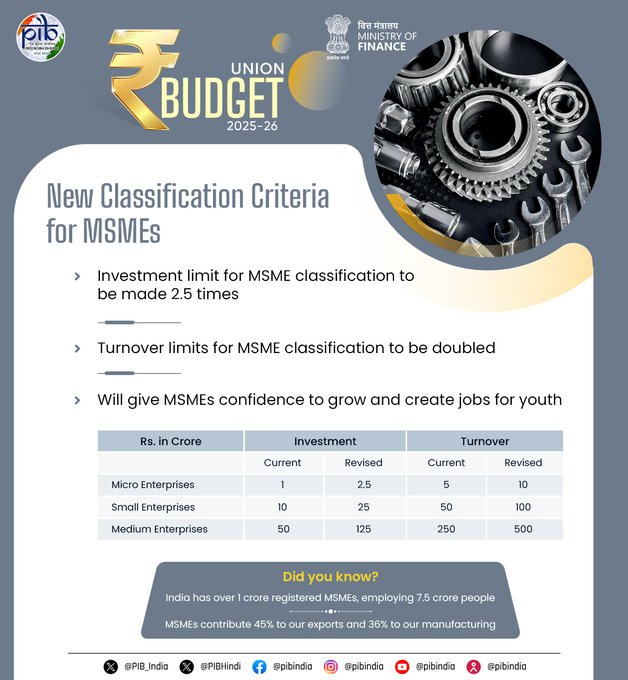

2. Increased Focus on Agriculture and MSMEs

Union Budget 2025 also outlined key measures to stimulate growth in critical sectors like agriculture and Micro, Small, and Medium Enterprises (MSMEs). Among the major proposals was the introduction of new classification criteria for MSMEs, which aims to enhance support for small businesses and encourage growth within this vital sector. A modified ‘Udaan’ scheme was also introduced, designed to improve regional connectivity and transport for businesses and consumers alike, especially in rural and underserved areas.

3. Education and Health Sector Boost

The budget also allocated significant funds to healthcare and education, ensuring long-term improvements in India’s infrastructure. A major initiative involves the addition of 75,000 new medical seats over the next five years, with 10,000 of them being made available in medical colleges as early as next year. This move aims to address India’s growing healthcare needs and the increasing demand for skilled professionals.

Additionally, Sitharaman announced a ₹20,000 crore fund to promote innovation through partnerships between the government and private sector, further fostering a culture of research and development.

Key Tax Proposals in Budget 2025

Personal Income Tax Reforms: Focus on Simplicity and Relief

One of the core features of Budget 2025 was the overhaul of personal income tax provisions. The new tax regime, which now exempts income up to ₹12 lakh, is designed to offer relief to middle-income earners, reducing their financial strain. In her address, Nirmala Sitharaman emphasized the need for tax systems that are straightforward, transparent, and easy for taxpayers to navigate, all while ensuring that tax evasion and litigation are minimized.

Rationalisation of TDS and TCS

To further simplify the tax process, the Finance Minister introduced measures to rationalize Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) norms. These adjustments are expected to reduce the compliance burden on taxpayers, especially for small businesses and individuals.

Reducing Compliance Burden

With an eye on improving the ease of doing business, Budget 2025 includes steps to cut down the red tape that often hinders growth. The government is focused on reducing unnecessary paperwork and procedures, enabling businesses to operate more efficiently.

Investments in Infrastructure and Innovation

Fiscal Deficit and Infrastructure Investments

In terms of fiscal management, Sitharaman projected the fiscal deficit to be at 4.4% of GDP. Alongside this, the budget allocated significant resources for infrastructure projects, particularly in aviation and regional connectivity. The government plans to build greenfield airports in Bihar, supporting the region’s future economic growth by improving air transport.

Modified ‘Udaan’ Scheme to Enhance Regional Connectivity

The modified ‘Udaan’ scheme is another key announcement designed to boost regional connectivity. This initiative is set to enhance air travel options for millions of middle-class citizens across smaller towns and remote areas, enabling them to travel more easily and economically. The scheme is expected to add 120 new destinations and provide significant support to hilly, northeastern, and aspirational districts.

Budget 2025 and the Road Ahead

Union Budget 2025 sets the stage for a more dynamic and inclusive economy. With major tax reforms, investments in key sectors, and measures designed to enhance ease of business, the government has laid down an ambitious agenda for growth. The proposed changes, particularly the new income tax regime, will have a lasting impact on the lives of millions of middle-class taxpayers.

As Nirmala Sitharaman continues her record-breaking tenure as Finance Minister, the impact of Budget 2025 will likely be felt across various sectors of the economy, from agriculture to healthcare and beyond. The tax relief and regulatory simplifications aim to bolster economic activity, create jobs, and improve overall quality of life for the average citizen.

Conclusion: Budget 2025’s Impact on the Indian Economy

Union Budget 2025 offers a comprehensive roadmap for India’s economic growth and development. The major tax relief measures, including the ₹12 lakh income tax exemption, combined with strategic investments in critical sectors, are set to drive the country towards a more prosperous future. As the government focuses on fostering innovation, reducing compliance burdens, and enhancing regional infrastructure, it is clear that the roadmap for the next financial year will focus on both short-term relief and long-term growth.